As the national economy gains momentum, remodeling is poised for a recovery. But the growth curve will be shallow, not the “hockey stick” pattern that began in 2004. Success will depend on how well remodelers meet the challenges of tougher competition, reduced federal energy funding, demand for smaller projects, increased regulation, and tight credit.

GAME, SET, MATCH!

The recent downturn has flooded the remodeling market with former new-home builders and subcontractors trying to keep their hand in and displaced and laid-off workers looking to make ends meet. Most established companies are having a hard time competing against the impossibly low prices offered by these interlopers, but some have met the challenge. Here’s how three remodelers came out winners.

Designing Lifestyle

Hull Homes, of Fort Worth, Texas, recently went up against a fly-by-night competitor who didn’t know much about the historical and architecturally significant properties that are Hull’s specialty. “The other guy said he could do the job cheaper than anyone else,” says owner Brent Hull, “but he didn’t know what he was doing.”

The initial budget to remodel the circa-1938 Colonial revival house, complete with a 1960s addition, was $500,000; Hull bid $600,000, and the competitor came in at $485,000 (a fact Hull learned from the project’s interior designer). To justify the higher bid, Hull focused on his company’s design capabilities, emphasizing the home’s historical significance, and the need to preserve the property’s value with a “blended” approach that incorporated the original structure and the addition. Hull presented an open-book budget, including all of his firm’s material and labor costs. “We made it transparent for the homeowners,” he says, “and told them that if they went with our design/build model, they wouldn’t have to spend an additional $10,000 to $30,000 on architectural plans.”

The pitch worked, and since the project was completed in late-2010, Hull has received referrals from the homeowners. The experience taught him how to “separate his professional remodeling practice from the knuckleheads,” he says. “There are a lot of guys who claim to be the cheapest or the fastest, but when you’re the one who can show design ideas, complete budgets, references, and proven systems, you’ll win out.”

Lead Education

When Ben Trannel, owner of Case Handyman and Remodeling of West Des Moines, Iowa, received a referral to bid on a residential window replacement project, lead paint regulations were one of his first concerns. The home, built in 1977, was occupied by a family with young children and located in a state with a high rate of childhood lead poisoning. “The homeowners asked the other contractor about the issue,” says Trannel, who is lead-safe certified, “and he told them not to worry about it.”

Trannel saw his opportunity and educated the homeowners on the lead paint issue and the cost of complying with Iowa’s new regulations. Despite a tight budget, Trannel’s professionalism, coupled with the desire to prevent their young children from ingesting lead paint, helped the homeowners decide to reject the competitor’s lower bid. Trannel’s company has since completed several other projects for this client and has also bid on a master bathroom remodel. “You gain points by being open about additional costs and implications,” Trannel says.

Package Deal

In 2010, a long-time customer of Artery Remodeling, in Frederick, Md., came to Jim Weaver, the company’s sales manager, to talk about what they would actually get in return for their investment in a kitchen remodel. After getting bids from several contractors, Weaver says, “They could see that they were being hoodwinked, and that the other contractor wasn’t going to provide a complete job.”

The project included relocation of the kitchen, which could create unexpected costs. “I told the client that we don’t have X-ray eyes,” Weaver says, “but that we do have enough experience to know what could be there and how much it would cost to deal with.”

Weaver also saw an advantage in accommodating the clients’ busy schedules, which found them leaving early in the morning and not returning home until after 6:30 p.m. “They needed an all-inclusive, turnkey package with no surprises,” Weaver says, “and that’s what we were offering.”

Artery Remodeling won the bid and completed the project in late-2010. Weaver says that the experience validated his way of breaking down proposals into small, digestible pieces that the consumer understands. “Even if the bids are similar in price, they may not always be the same in scope,” Weaver says. “Make the consumer understand that ahead of time and include all of the fine details in your contract and you’ll have a better chance of winning the project.” —Bridget McCrea is a freelance writer in Dunedin, Fla.

Getting Small

Installing a ceiling fan is easy, right? To you. But not to the average homeowner. Which suits Darryl Rose just fine. Rose, owner of Get Dwell, one of more than 75 handyman companies in the Chicago area, daily dispatches his seven technicians to troubleshoot leaks, install locks, fix screens, and demolish ice dams.

Although sheer need drives a huge demand for handyman services and replacement jobs, few remodelers want to bother with a ceiling fan or a new roof, unless it’s a favor to loyal clients. But with large projects a scarcity, many remodelers have ventured into maintenance, repair, and even replacement jobs to keep crews busy and cash flowing. If you’re thinking about going in that direction, the key question is why.

“If your approach is: ‘I am doing it now because I have to and I can’t wait until I don’t have to,’ that’s the wrong approach,” says Ken Moeslein, CEO of Legacy Remodeling, a Pittsburgh company that does both replacement and design/build contracting. Better, he says, to ask yourself: “Is this a part of the business I really want to be in and grow in, or is it simply to hold me over until business comes back?”

Separation Is Key

Companies that have taken on handyman or replacement work find challenges — generating leads, finding installers, pricing for profitability — that are best resolved by creating a separate division. In September 2009, for instance, David Adams, owner of Design Builders & Remodeling, in Ridgefield, Conn., entered the replacement market by launching New England Window & Door Co. with its own phone number, salesperson, and marketing. “We didn’t want to be seen as a remodeling company offering replacement products,” says general manager John Bedosky. “We wanted to be seen as a stand-alone replacement company with separate ads and a separate budget.”

Before establishing New England Window, DB&R created a marketing campaign, found seasoned window installers, and hired an experienced salesperson. Last year volume topped $1 million, and the goal is to reach $3 million in the next few years.

Separate management can also make a critical difference. Jason Larson, owner of Lars Construction, in San Diego, built JayCor, the window company he started in 2001, into a $2 million business. He found that the vinyl window industry is hypercompetitive, that he was selling “a commodity rather than a skill,” and that JayCor was a “huge distraction” from his design/build business. Four years later, he sold the window business.

Partner Up

It’s easier to go from replacement to full-service than vice versa — so say companies that have made the transition. Replacement jobs are small and turn quickly. Legacy Remodeling, for instance, might wrap up five or six window jobs in a day. Those jobs, Moeslein says, not only have to be closed out and collected, but a half-dozen new jobs started the next day, and the day after that. And compared with parent company DB&R’s average job size of $100,000, New England Window averages $7,400 per job. Few design/build remodelers have the systems to manage that level of activity.

The best way to go may be to align your operation with handyman or replacement companies you can recommend in the event that customers ask if your company “does that kind of work.” Get Dwell, for instance, recommends an area remodeler for more complex projects, including kitchens, who in turn refers back his many requests for handyman work. “The last thing he wants to do is fix a squeaky floor,” Rose says. “We love it.”

Energy Goes Local

The federal energy programs that everyone was talking about last spring appear to be hopelessly stalled. The Home Star legislation introduced last year would have provided rebates to homeowners for energy-efficient retrofits for windows, insulation, and HVAC. Approved by the House, it currently awaits Senate action, and proponents of the program can’t guess how it will progress with the new Congress. The residential energy-efficient retrofit market took another hit when Fannie Mae and Freddie Mac decided to deny mortgages to homeowners who financed energy work using Property Assessed Clean Energy (PACE) programs, which would have provided homeowners with up-front money needed for the upgrades, allowing them to pay for the work over time via their property taxes.

Current hopes for energy retrofit financing are pinned to the PowerSaver Loan program, currently in its pilot phase. Under that program, the Federal Housing Administration (FHA) would provide mortgage insurance for low-cost loans offered by private lenders. Lenders who lower interest rates and provide other borrower benefits may also be eligible for incentive grants.

California Co-op

Instead of waiting for federal programs, the California Energy Commission and the California Public Utilities Commission are bringing together utilities and local programs under one umbrella called Energy Upgrade California (EUC).

According to Panama Bartholomy, the Energy Commission’s deputy director of the Energy Efficiency and Renewables Division, in Sacramento, “The money can go farther if you coordinate.” Bartholomy says that, instead of having to contact many separate entities, homeowners using EUC fill out a single application and receive a list of contractors that fit the requirements for all of the programs involved. He says that the program will help the in-home sales process because contractors could use the EUC website to show clients their financing options.

By the Numbers

Energy retrofits may get a boost from something called the Home Energy Score. Under the plan, a home energy audit would score a home on a scale of 1 to 10 and provide the homeowner with a list of recommended energy improvements and the associated cost savings estimates.

The plan is currently in a pilot phase with 10 testing locations throughout the country, including United Cooperative Services, a Cleburne, Texas, utility with an existing home energy audit program that completed nearly 2,000 assessments in 2010. In 2011, UCS plans to score more than 250 homes using the Home Energy Score tool. “I think energy usage is going to be a huge selling point going forward,” says Marty Haught, senior vice president, Communications & Public Relations. “We wanted to … make sure our members are equipped to deal with high energy costs in the future.” UCS analysis has found that households completing an energy audit used 100 kilowatts less, on average, than the co-op’s overall membership.

Based on findings from the pilots, the Department of Energy will refine the program and plans to launch Home Energy Score nationally in late 2011.

Red Tape Rising

Remodelers will have more regulation issues to deal with in the coming year. Here are four that are certain to attract their fair share of attention.

Sub vs. Employee

Many companies that laid off employees during the recession are reluctant to start rehiring. Instead, they are subcontracting labor as they need it. That may make sense in the short run, but many states are making it more difficult for contractors to prove that independent contractors are not employees. “The growth of so-called ‘anti-1099 labor’ legislation will continue well into 2012,” says D.S. Berenson, Washington, D.C., managing partner of Johanson Berenson LLP. “We now have such laws targeting the remodeling industry in 16 states, and the trend will continue.”

Contractors currently flying under the radar are taking a big risk. Negligent noncompliance can result in stiff fines, and intentional violation may bring criminal penalties. And if the Internal Revenue Service reclassifies a sub as an employee, the negligent business will pay not only fines but all back payroll taxes plus any accumulated interest.

More 1099s?

The 2010 health reform law contains a new requirement for filing form 1099, which contractors are currently required to issue to companies paid more than $600 in a given year. The new provision removes two exemptions: beginning Jan. 1, 2012, payments to a corporation must be included, as well as money spent to purchase merchandise. “The good news,” Berenson says, “is that … there is strong support for repealing … the so-called ‘form 1099 headache.’” However, because the new requirement is expected to raise tax revenue from underreported business income, it is conceivable that states looking to replenish depleted budgets may introduce similar legislation at the local level.

$511: Value of one year’s energy savings for an average home that is 30% more energy efficient (accounts for loan payment to pay for energy improvements) Source: ACEEE.org

New Energy Code

In October 2010, state and local code officials adopted the 2012 International Energy Conservation Code (IECC), the national energy code that serves as the model for more than 80% of state and local building codes. Also known as the “30% solution” because of the energy savings it is expected to achieve versus the 2006 code, the new code introduces measures to improve air tightness; increase window and skylight efficiency; boost insulation levels; improve lighting efficiency; and reduce energy losses from hot water storage and piping and from HVAC equipment and ducts. Building officials also voted to replace the International Residential Code’s energy chapter with the IECC, according to the Institute for Market Transformation.

For more information, check the website of the American Council for an Energy-Efficient Economy, which includes an interactive map showing state energy efficiency policy.

Whistle-Blowing

Although remodelers constantly complain about fly-by-night contractors and an underground remodeling economy, most are reluctant to report competitors who work without permits or the required licensing and insurance. Though there is no legal reason not to report these kinds of violations, “the concept is distasteful to everyone,” Berenson says. “But the world is changing, and many contractors are running so far under the radar, ignoring many laws and regulations that everyone else has to deal with, that the playing field is unfairly tilted away from the legitimate contractor to a degree we have not seen before.”

PAY PALS

It has always been challenging to run a remodeling company. But the new challenge is helping fence-sitters and those with little liquidity make a decision and find creative ways to fund their remodeling projects.

Pay as You Go

Remodelers who relied on clients borrowing have not only had to bone up on other options but have also had to change their business strategies. The future calls for making connections with bankers, mortgage lenders, and real estate agents and educating yourself and your staff about the various financial products available, including things like 203(k) loans, reverse mortgages, revolving credit, and The Energy Loan (see “Cashing In,” for more about financing options.)

To be successful, you must have your own house in order since many project-funding options require you to float job costs. “You need to have a healthy cash flow balance sheet,” says Dino Andreakos, whose Bullfrog Builders, in Queens, N.Y., has developed a niche doing 203(k) loan-funded projects; the smallest one for this year is $240,000. “You’re always laying out money until you hit your profit margins,” Andreakos says.

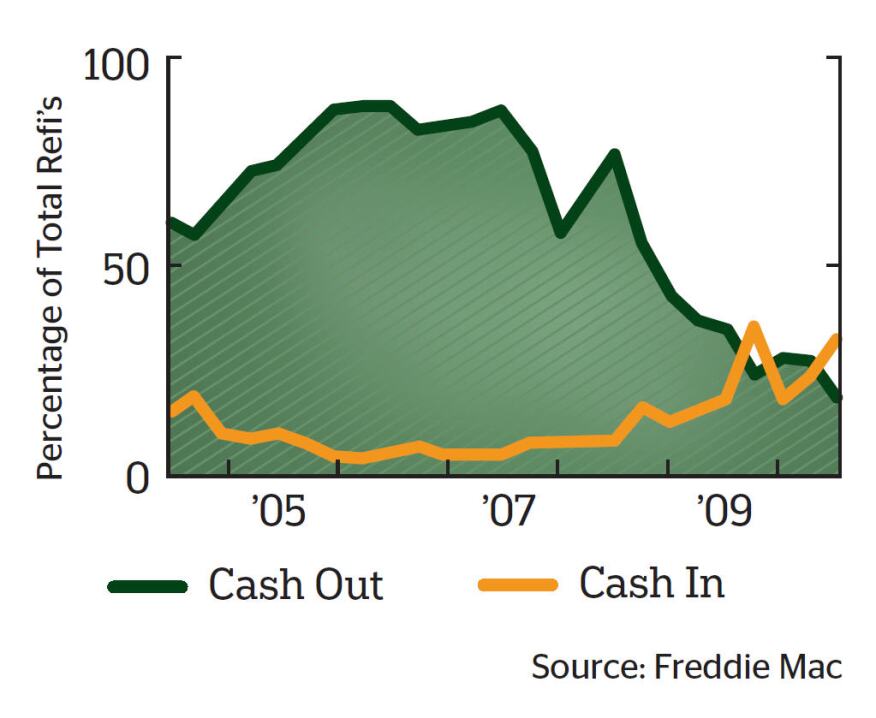

Cashing In

Long a funding source for residential remodels, cash-out refinances reached their lowest level since analysis began in 1985. By contrast, cash-in refinances, in which homeowners paid down their mortgage, reached record highs twice during the last 12 months.

Bullfrog Builders offers several financing options and has two full-time people devoted to financing who understand the products and process, educate the company’s salespeople, and review homeowners’ credit histories.

Bullfrog’s salespeople use a Microsoft PowerPoint presentation to discuss financing at the first client meeting. “We offer it the same way the clerk at the register at Macy’s asks if you want to open a Macy’s card. It’s part of the process,” Andreakos says.

Funding Fit

As funding slowly loosens up, it will help to know what options you can offer your clients.

Credit card: Though convenient, especially for small repairs, Kathy Shertzer, office manager and gatekeeper at DuKate Fine Remodeling, in Franklin, Ind., warns remodelers to be wary. Fees tied to mileage and other perks add up fast. “When we reviewed our overhead, it was easy to see we didn’t need to be accepting credit cards,” Shertzer says.

Unsecured/revolving credit: Offered by GE Money and Wells Fargo, this type of financing has been widely used by replacement contractors for amounts up to $25,000. In exchange for fees for administration and promotion, qualified contractors can offer 24-month no-interest loans and other options. The lender vets the consumer’s credit and pays the contractor at project completion.

Construction loan: Consumers typically need credit scores of 720 to 750 to qualify for a loan that replaces the existing mortgage, covering up to 80% of the estimated post-construction property value. The lender requires plans, specs, and a construction budget, and parcels out payments to the contractor based on a completion schedule.

Second mortgage: While a traditional second mortgage is based on current property value, a “home improvement second mortgage” bases the loan amount on the value of the home after the work has been done. Paid in a lump sum, the loan becomes a second lien on the property.

Home equity loan: This is a one-time loan borrowed against the equity that consumers have in their home. A Home Equity Line of Credit (HELOC) is a revolving line of credit with an adjustable interest rate. It’s more difficult to get lines of credit now because of the recent drop in home values in many markets.

203(k) rehab loan: Backed by the Federal Housing Administration, this loan goes toward the cost of purchasing (or refinancing) and remodeling an existing home. The loan amount is tied to the value of the property after renovation and the loan-to-value ratio, traditionally 80%, may go as high as 110%. Although luxury products are not covered, many types of improvements qualify.

The consumer must hire a certified consultant, chosen from an official list, to check the contractor’s work. The contractor is paid in several draws tied to progress. Although remodelers have complained about slow payment, payment always comes.

Reverse mortgage: Available to homeowners age 62 and older, this FHA-backed mortgage makes payments to the homeowner, and the loan amount is added to a property lien. The loan is repaid from proceeds on the sale of the home when the homeowner dies or sells or leaves the property.

Andreakos, of Bullfrog Builders, has worked with clients using this type of financing and cautions that “It’s a tough pitch. You know, the owners have to talk to the whole family.”

The Energy Loan: This unsecured installment-based loan from Fannie Mae ranges from $2,500 to $20,000. Many projects are eligible, provided at least $1,000 worth of work is for energy improvements.

Fannie Mae–approved contractors send homeowner applications to one of three approved lenders — ViewTech Financials (Calif.), AMC First (Pa.), and WECC (Wis.) — to get underwriting approval. When the customer signs a completion certificate, the lender pays the contractor. Lenders are paid fixed transaction fees by Fannie Mae, not by the contractor.

Energy Improvement Mortgage: A type of energy-efficient mortgage, an Energy Improvement Mortgage (EIM) is used to include the cost of energy improvements in the mortgage for an existing home without increasing the down payment.

The additional amount is based on a home energy rating that ties the value of the energy-efficiency measures to estimated monthly energy savings. EIMs are offered by federally insured FHA and Veterans Affairs programs. (Click here for more information.)